Project details:

This project builds a machine-learning model that predicts which banking clients are likely to churn. Using demographic and behavioural data, several classification algorithms were trained and tuned on an imbalanced dataset. The final model achieved a strong F1 score and AUC-ROC, helping the bank prioritise retention efforts and improve customer lifetime value.

Description

Business Context & Problem

The Bank noticed a steady rise in customer churn, which directly affects revenue and increases acquisition costs. Retaining an existing client is significantly cheaper than attracting a new one, so a predictive model can help identify customers at risk before they leave. This project focuses on forecasting churn to support the bank’s retention strategy.

Data & Analytical Approach

The dataset contained customer information such as age, tenure, account balance, credit score, number of products and activity indicators. Initial steps included handling missing values, transforming categorical variables and exploring feature distributions. Because the dataset was imbalanced, resampling techniques were applied to stabilise model performance. Multiple models were trained and validated, with hyperparameters tuned to improve generalisation.

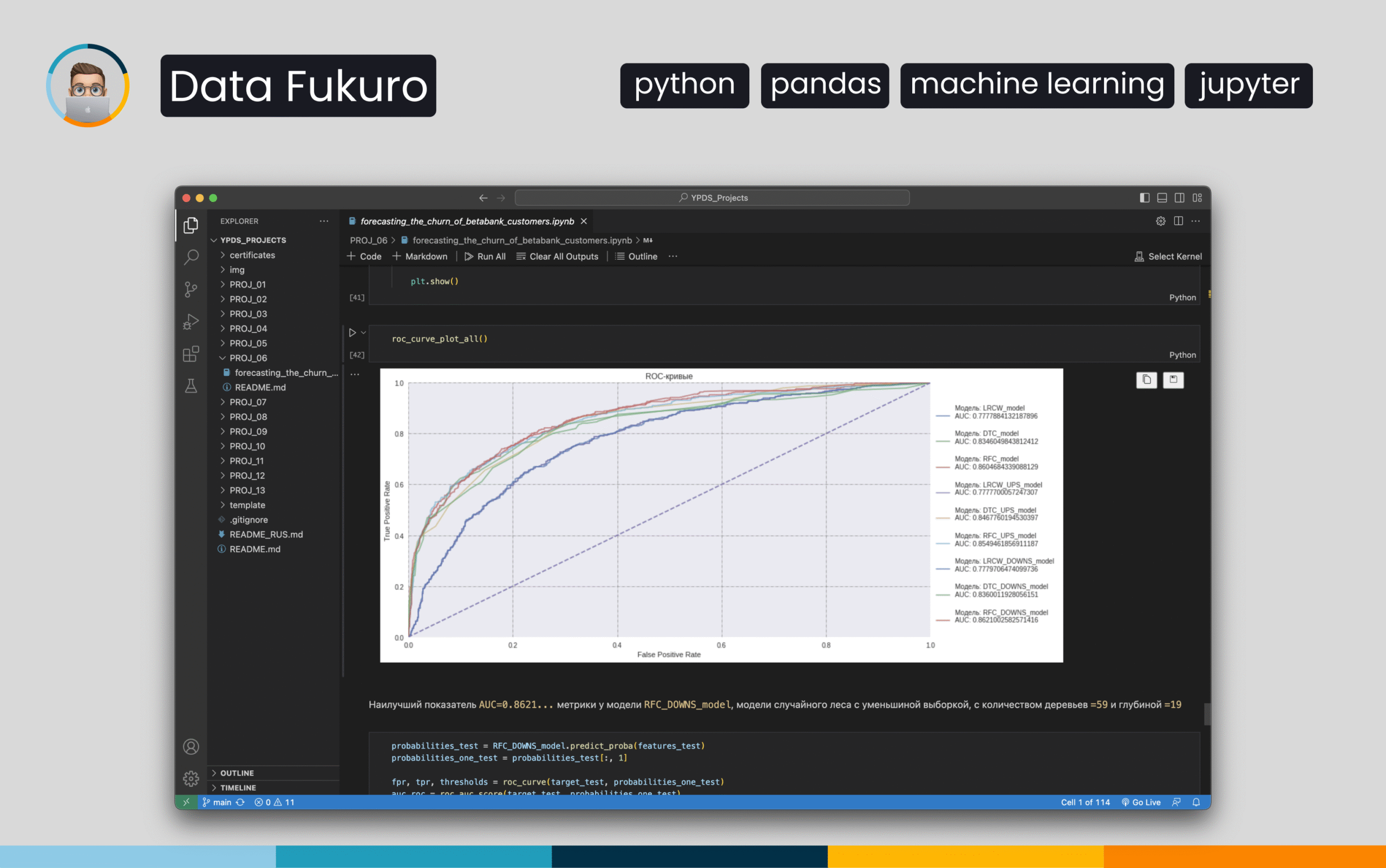

Statistical / ML Analysis

Several classification algorithms were compared using Scikit-learn, including logistic regression, random forest and gradient boosting. Evaluation was based on F1 score due to the imbalance between churners and non-churners. AUC-ROC was also analysed to understand how well the model separates the two classes. Through tuning and resampling, the F1 score exceeded the project requirement and performed reliably on the test data.

Key Insights & Final Recommendations

The model highlights clear behavioural and financial indicators associated with churn. Customers with lower activity levels, shorter tenure or specific financial profiles showed a higher predicted churn probability.

The bank can use these insights to design early-intervention retention campaigns, personalise outreach and focus resources on high-risk segments.

Overall, the project delivers a practical churn-prediction model that supports smarter retention planning and reduces customer loss.